Insurance Contracts may contain exclusion clauses. But the exclusion clauses won’t give the insurer the right to completely deny a claim. The insurer may still remain liable to a certain extent.

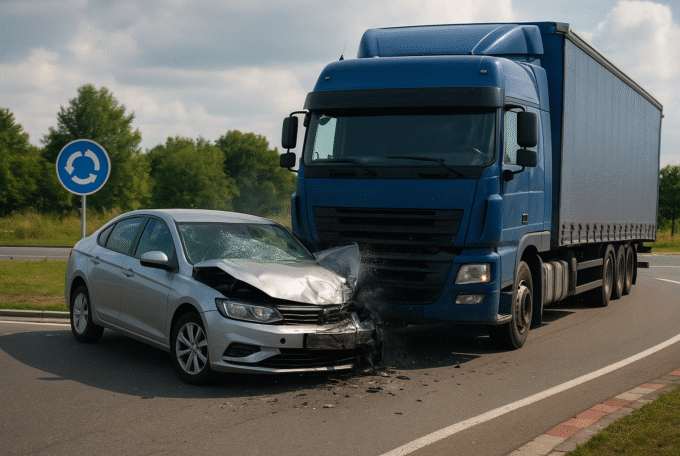

A motor vehicle insurance policy may exclude underbody damage cover, overhead damage cover or restrict cover for the insured to certain geographical areas. Insurance contracts may also contain clauses not covering insureds against; acts of God, drink driving and criminal activities.

Breach of an exclusion clause may give the insurer the right to refuse to payout a claim, but to the extent of the breach. The insured person may still be entitled to a partial payout. For example, where a motor vehicle insurance policy does not provide cover for overhead damage to the insured motor vehicle, in an incident involving damage to both the roof of the vehicle and it’s body, whilst the insured may still be entitled to claim all damages to the body of the vehicle, the insurer may be entitled to refuse to provide cover for the damages to the roof of the vehicle.

An insured person is further protected by section 54 of the Insurance Contracts Act. Section 54 gives the insurer the right to refuse a claim in certain circumstances. But, generally, it does not allow the insurer to reject an insurance claim by reason of an act or omission of the insured. The insurer’s liability however, in respect of the claim is reduced by the amount that fairly represents the extent to which the insurer’s interests were prejudiced. Meaning that the insured person is still entitled to a partial payout of their claim less any prejudice that the insurer suffered as a result of the act of the insured.

Interestingly, section 54 (3) provides that where the insured proves that no part of the loss that gave rise to the claim was caused by the act of the insured, the insurer may not refuse the claim by reason of that act. This raises the question as to whether the insurer can refuse a claim (under section 54) if the insured was driving whilst under the influence of alcohol but did not cause the collision and in other words was an innocent party to the crash caused by another person? According to section 54 (3), they may not be able to refuse cover, but if cover is excluded by the terms of the insurance policy they can.

Insurance disputes are complicated. If you have a claims disputes, please contact us for further advice.