Right of subrogation is a commonly misunderstood principle.

The Concise Australian Legal Dictionary defines subrogation as: “the substitution of one person for another in respect of a lawful claim, demand, or right, so that the person substituted succeeds to or acquires the right, remedies, or securities of the other in relation to the claim.”

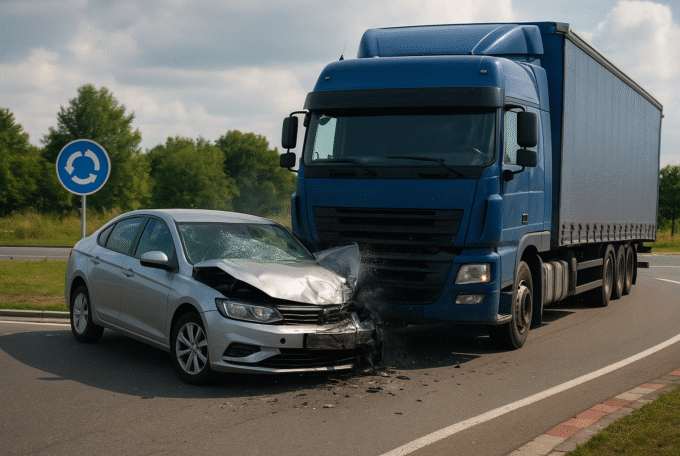

Lets demonstrate right of subrogation in a hypothetical scenario.

Sam is driving a Toyota Hilux with a bulbar attached to its rear and scratches Ana’s 2022 model Bentley. Ana has insurance and Sam is relived. Sam wipes off the dust from his bulbar and moves on with his life. Ana lodges a claim with her insurer and fixes her car, with the cost of repairs totaling $100,000 which is paid by Ana’s insurer. Why $100,000? Because it’s a Bentley.

Ana’s insurer has the right to recover the $100,000 loss they suffered from Sam, under Ana’s name. This is the known as the insurers right of subrogation.

The insurers right of subrogation is generally a term stipulated within the contract of insurance. It gives the right to the insurer to recover their loss from the at-fault party who caused damage to the insured property under the insured persons name.

Any legal action is brought in the name of the insured person. The insurer cannot sue the third party directly under their own name. The third party likewise cannot sue the insurer directly and their counterclaim (if any) needs to be made against the insured person.

If Sam is insured, he can lodge a claim with his insurer which they can defend under his name by rights of subrogation vested in them. If he doesn’t have insurance, he needs to arrange his own defence.