The method of calculating consequential loss as a result of damage to a business or an income earning chattel is to compare the turnover in the months following the damage, with that in the corresponding period in the twelve months preceding it. This method of calculation however gets tricky if special circumstances apply. For example, the COVID-19 pandemic which placed a halt on generation of revenue for businesses.

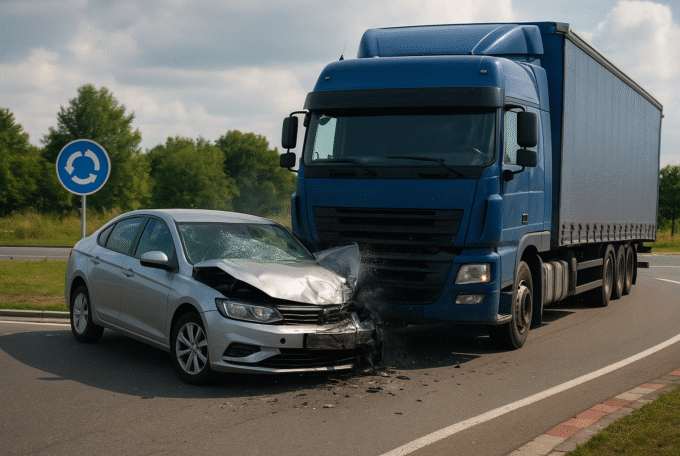

If a semi-trailer runs into a store and damages the entire stock, rendering the business inoperable for March, April and May 2023, the loss of turnover during those months can be found by means of a comparison with the turnover for March, April, May 2022.

The precise method should be to calculate the loss of turnover of the business, not the net profit. A comparison of the profit cannot show the amount of consequential loss sustained, but the comparison of turnover throughout the period of interruption is ascertainable and provides an accurate basis for measuring consequential loss. The business would have overheads and expenses, such as wages, consumables, fuel costs, energy costs… and administrative costs. For the purposes of calculating consequential loss, it is not appropriate to base the loss on the net profit earned for those months. The determination of net profit/loss of the business is an accounting matter for the business to be determined at the end of the financial year. The determination of consequential loss should be based on the revenue of the business.

Note: This is a general guide only. Circumstances may vary and advice should be sought about your specific circumstances.