Characteristics of insurance The fundamental characteristic of a contract of insurance (COI) is that it involves the insurer taking on “risk.” The risk assumed is not confined to the possibility of unknown perils, but also includes: threats of legislative changes impacting the insured risk; the possibility of courts making findings adverse to the insurer’s interests […]

Agency is a tripartite relationship in which one person (the agent) has the authority to create legal relations between a principal and a third party. If an agency relationship exists, the agent’s actions can create binding legal relationships between the principal and the third party. Therefore, agency can have significant legal implications for principals and […]

Insurance, indemnity and guarantee are distinct contractual arrangements with different purposes. The distinction among these contracts poses difficult questions of construction and interpretation, but the categorisation of the contract has a significant effect on the rights and obligations of the parties. While the principle of indemnity applies to both insurance and guarantee, there are a […]

An insurance policy is a contract comprising a promise by the insurer to indemnify the policyholder for loss as defined under the policy, in return for consideration of the payment of premium to the insurer. The purpose of the insurance policy document is to assemble, set out and record the intentions of the parties for […]

The term “without prejudice” is a common law rule that enables the opposing parties to negotiate without fear that adverse inferences may be drawn from what they say during settlement negotiations, whether written or oral. Under this rule, statements made by the parties with a view of resolving or narrowing a dispute will be inadmissible […]

‘Accord and satisfaction’ is a two-pronged legal doctrine which was defined concisely by Gummow J in Thompson v Australian Capital Television Pty Ltd [1996] 186 CLR 574 as consisting of an ‘agreement or consent (accord) to accept something in place of the full remedy to which the recipient is entitled (satisfaction)’. Through gradual finessing of […]

The method of calculating consequential loss as a result of damage to a business or an income earning chattel is to compare the turnover in the months following the damage, with that in the corresponding period in the twelve months preceding it. This method of calculation however gets tricky if special circumstances apply. For example, […]

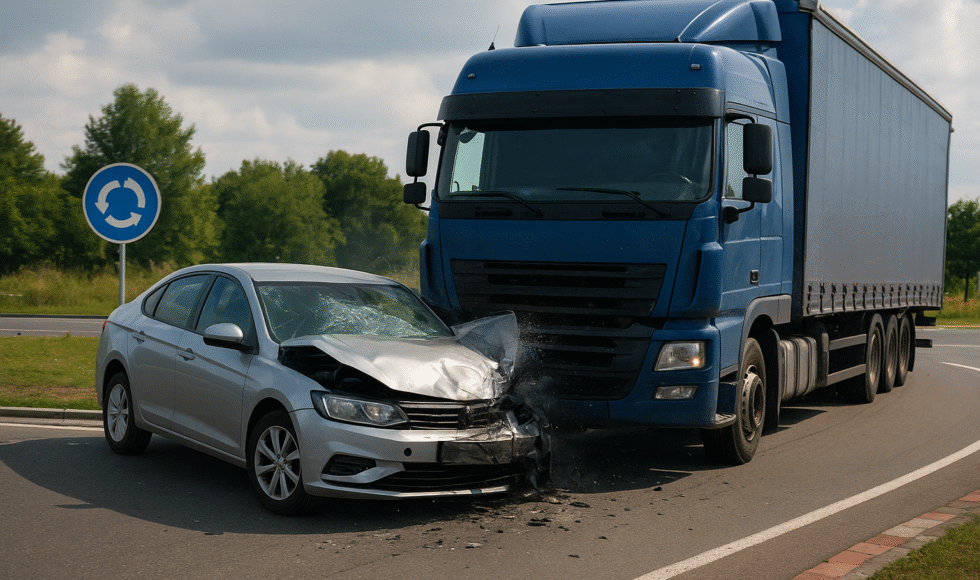

In an action for damages, a plaintiff would generally have a claim for direct damages. For example, a claim for cost of repairs of a damaged vehicle. This is commonly referred to as special damages or economic losses. Direct damages are generally easily calculated as they would be supported by invoices, receipts and/or assessment reports. […]

Background When we think about property damage, we often focus on the physical damage, transport expenses, and loss of property. However, there is another significant aspect that is often overlooked: the loss of amenity of use. This legal concept recognises the intangible impact that injuries can have on a person’s enjoyment of life, their ability […]

Here’s a quick reference note on limitations of actions for debt recovery in all jurisdictions (according to current law). Fort debts, in every jurisdiction (except for the Northern Territory), a debt may not be recoverable after a period of 6 years from the date on which the cause of action first accrues. In the Northern […]